Close More Sales with 0% Merchant Fees

Offer 6-month payment plans to your business customers. You get paid upfront. They pay weekly.

-

Get paid day one

Get paid day one

-

No merchant fees

No merchant fees

-

We handle repayments

We handle repayments

How It Works

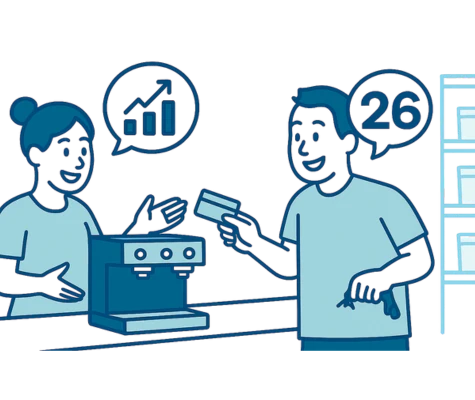

Offer Funding Loop Pay

Let your business customers choose to split their invoice over 26 weekly payments.

Customer applies

They complete a simple online application and submit documents.

Approval & first payment

Once approved, the customer accepts the plan and makes their first payment.

You get paid

As soon as the first payment is received, you’re paid in 24-48 hours. We handle the rest.

Why Offer Funding Loop Pay?

Get Paid Upfront

No waiting. Full amount hits your account on day one.

Increase Conversions

Let customers buy now and pay over time.

Grow Order Sizes

Flexible payment terms increase the average spend.

No Cost to You

100% free for merchants. The customer pays the fee.

No Risk

We handle repayments and collection.

Stand Out

Attract more customers with smarter payment options.

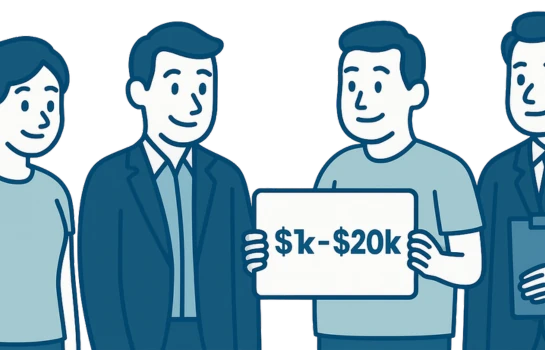

Who’s It For?

Sellers with business customers

For businesses selling to other businesses

$1k - $20k Invoices

Best suited for mid-sized invoice amounts.

Looking to Boost Sales

Offer flexible terms to drive more orders.

Want to Get Paid Faster

No more waiting - get paid upfront.

How It Works for Your Customers

Customer Eligibility

- In business for 12+ months

- Business must be a company structure

- Minimum $10,000 monthly turnover

What It Looks Like for Customers

- First payment: Taken on the day of purchase

- Then: 26 equal weekly repayments

- Cost: 7.5% fee added to the invoice amount

Example: $5,000 invoice → $5,375 total repaid over 6 months

No hidden fees. No surprises.

Get Started in Minutes

-

No setup cost

No setup cost

-

Fast settlement

Fast settlement

-

Free merchant support

Free merchant support

Frequently asked questions

What documents or business information do I need to apply?

Can I apply if my business is new or has limited trading history?

Can I apply for more than one type of finance at the same time?

To begin, we’ll present you with indicative offers based on the information you provide. This allows you to compare your options upfront without any credit checks or impact on your credit score.

We typically don’t submit a formal application right away, as that would involve a credit enquiry. Our approach ensures you can review your options first before proceeding with any formal applications.